"No technology has ever had the opportunity to address a larger part of the world's GDP than AI…We're really just three years into that journey…I'm fairly sure that we're at the beginning of this new era" - Nvidia CEO Jensen Huang

Mark Zuckerberg and Jensen Huang image courtesy of Evan on X

February Fears

Tariff Trouble

One Fell Swoop

Not even Nvidia (Nasdaq: NVDA) could stop this stock market rout. Not only has the stock market widened its February loss as a result of today's sell-off, but the S&P 500 has lost the momentum it had headed into 2025, erasing all of this year's gains for a 0.34% year-to-date decline. The tech-heavy Nasdaq Composite is down an even steeper 3.9% year-to-date. This month also marks Bitcoin's most significant decline since mid-2022.

After reporting a blowout Q4 earnings report, surpassing even the wildest of estimates on the top and bottom lines, Nvidia's stock got hammered on Thursday, reeling about 8.4% and sending its market capitalization below the psychologically sensitive $3 trillion threshold. With Nvidia out of that club, Apple (Nasdaq: AAPL) is now the only stock with a market cap hovering above $3 trillion.

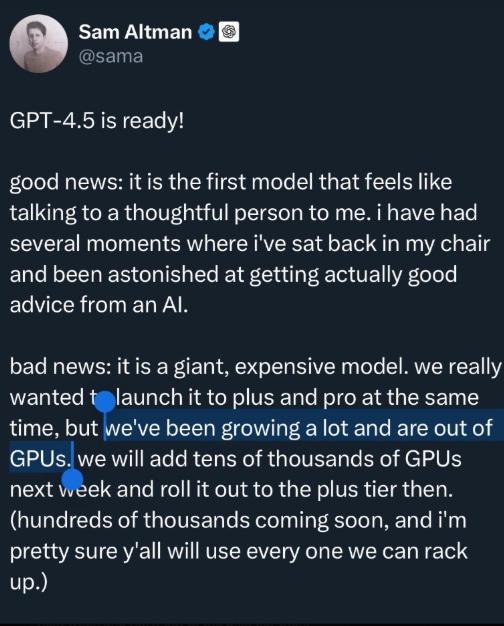

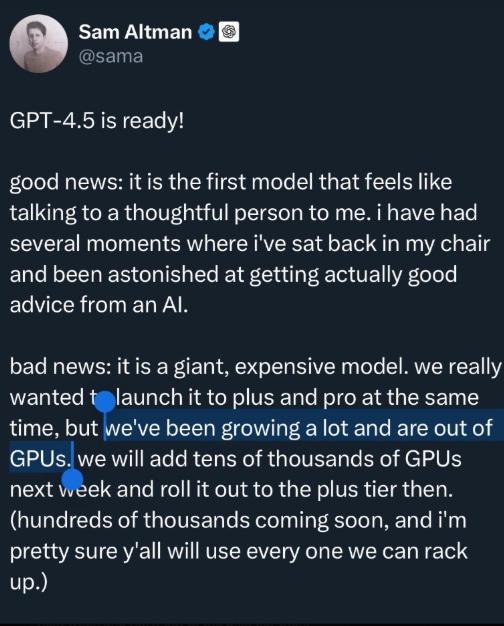

While Nvidia got caught in the selling, it's not reflective of the robust demand for AI chips. In fact, Nvidia CEO Jensen Huang made it clear that demand for its AI chipsets is through the roof. And his company's data centers generated a whopping $100 billion-plus from data center revenue alone in 2024. Meanwhile, OpenAI, the company behind ChatGPT, has been growing hand-over-fist while CEO Sam Altman has announced it's now out of GPUs after releasing the latest ChatGPT 4.5 model.

Posting by Sam Altman on X

Mark Zuckerberg's Meta Platforms (Nasdaq: META) has revealed plans to go head-to-head with OpenAI by releasing its own standalone Meta AI app. And according to Amazon CEO Andy Jassy, no company is spending more on AI capex than his company, saying, "There's not enough chips and power to meet AI demand."

So, with all of this excitement around the AI revolution, what went wrong in the markets this week? In a word, tariffs. President Trump reemphasized his commitment to implementing tariffs on North American trade partners Mexico and Canada, attaching a date of March 4 to them and thereby making it official. China is also facing an additional 10% tariff while the EU is the latest region to be in the tariff crosshairs with the threat of 25% levies. Stocks had nowhere to hide, and in one fell swoop, the S&P 500 lost over $500 billion in market cap.

The markets don't like uncertainty, and right now there is a lot of it. "We're in a stalled, range-bound, slightly irrational market as we wait for policy clarity," according to Infrastructure Capital Advisors CEO Jay Hatfield, cited by CNBC.

Markets Snapshot

Index | Tuesday Close | Point Change | Percentage Change |

S&P 500 | 5861.57 | 🡇94.49 | 🡇1.59% |

Dow Jones Industrial Average | 43,239.50 | 🡇193.62 | 🡇0.45% |

Nasdaq | 18,544.42 | 🡇530.84 | 🡇2.78% |

The bond market is sending a warning that a recession could be around the corner, but this indicator is not always right. Earlier this week, the 10-year Treasury yield slipped below the three-month note, creating what's known as an inverted yield curve.

The Federal Reserve considers this setup a potential signal for an economic slowdown of recessionary proportions. The last time this happened was in Q4 2022, but the economy managed to stave off a recession at that time and ever since. The wildcard this time around is the Trump administration's aggressive policies, which has investors nervous that the inverted yield curve could be a harbinger of things to come.

Image by Pixabay

Market Movers

Chipmaker Advanced Micro Devices (Nasdaq: AMD) fell 5% on Thursday, sending the stock below the $100 level. The markets are nervous that the chip makers like AMD will face heightened restrictions on exports to China. In fact, Nvidia warned about the threat of greater AI competition from China, including the likes of Huawei.

Dell (Nasdaq: DELL) is returning greater value to its shareholders, announcing an 18% increase in its cash dividend to $2.10 per share and increasing its share buyback program by $10 billion. Michael Dell forecasts $15 billion in AI server revenue in 2025. But that did little to help the stock, which fell about 7% on Thursday.

Snowflake (NYSE: SNOW) has been a bright spot, with a two-day rally of 6% through Thursday. Snowflake has been advancing on a quarterly earnings beat. The company has an existing partnership with Microsoft (Nasdaq: MSFT) through which it has access to Azure's OpenAI technology for the delivery of the latest AI models.

Tesla (Nasdaq: TSLA) has shaved off 40% of its market value since its December high, causing CEO Elon Musk's net worth to spiral by a reported $22 billion. Nevertheless, Musk, who is heading up the U.S. cost-cutting bonanza, remains the wealthiest person on the planet.

Image Courtesy of X

March Madness

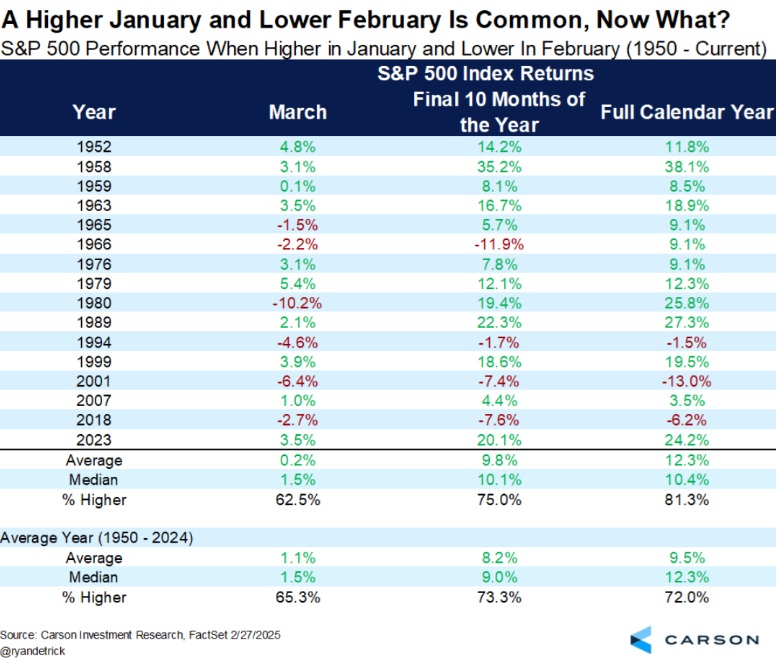

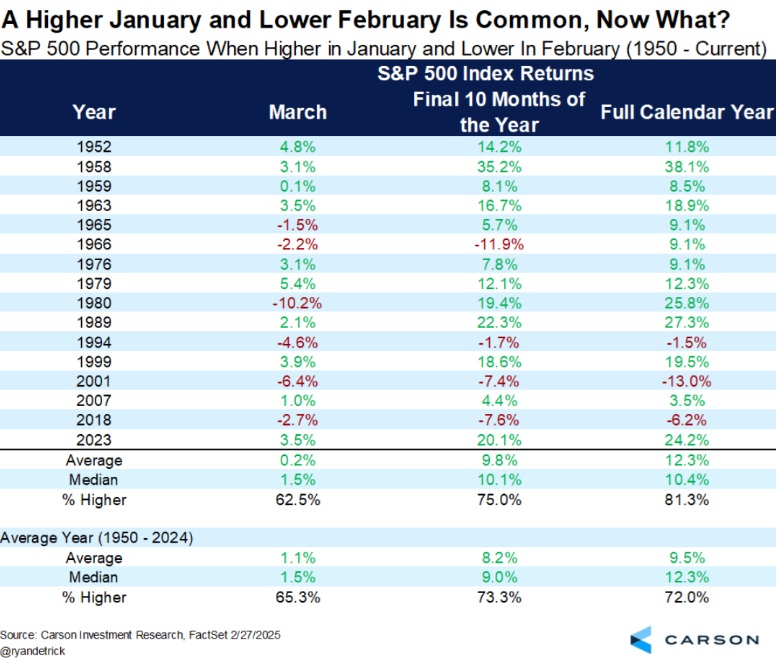

The stock market advanced in January but February's losses have erased all of those gains. This scenario isn't as uncommon as investors might think, as the below chart illustrates. Not only that but Feb. 27 has a reputation of being the worst performing day in one of the weakest months of the year. So in hindsight, stocks didn't have much of a chance, Nvidia or not.

Now the question becomes what is next for stocks? If history is any indication, March could go either way, but the final 10 months of 2025 as a whole have a pretty good chance for a better-than-average performance.

Looking Ahead

Disclaimer: We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of Bullish Bear nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisers, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on Bullish Bear. It is possible that a viewer's entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. Bullish Bear makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Some of the content on this website contains "forward-looking statements." Such statements may be preceded by the words "intends," "may," "will," "plans," "expects," "anticipates," "projects," "predicts," "estimates," "aims," "believes," "hopes," "potential," or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which may be beyond a company's control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. It is hereby noted that forward-looking statements contained herein may include everything other than historical information, involve risk and uncertainties that may affect a company's actual results of operation. A company's actual performance could greatly differ from those described in any forward-looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company's products; the company's ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company's filings with the Securities and Exchange Commission. However, a company's past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources bullishbear.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and Bullish Bear has no obligation to update any of the information provided. Bullish Bear, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Bullish Bear encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content.Bullish Bear, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does Bullish Bear control, endorse, or guarantee any content found in such sites. Bullish Bear does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Bullish Bear, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that Bullish Bear, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Bullish Bear uses third parties to disseminate information to subscribers. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm.