Dear Reader,

JC Parets has been called “The King of Technicals” by Fox Business…

The CMT Association called him “one of the most widely read market commentators of this generation.”

And Business Insider says JC is “Among the top financial people you have to follow…”

He’s predicted market moves with near-perfect precision — including the 2008 crash…

When he warned his clients just days before the market plummeted…

He also told his clients to get OUT of stocks in early 2020, at the exact peak before they dropped 30% in a matter of days...

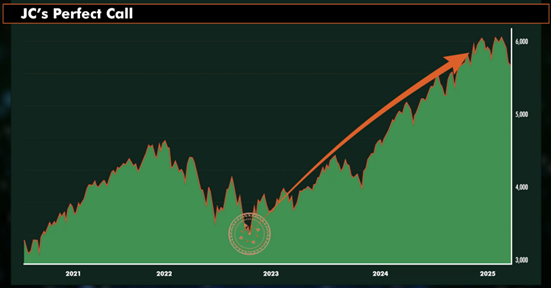

And he even called the exact bottom of the market on October 14th 2022, the precise moment before stocks rallied!

Now, he’s warning that a powerful market signal — one that’s preceded every crash for 50 years — will appear again on one specific date in the near future.

But before it does…

JC says we’re entering a short but explosive profit window — possibly the last of this decade.

Meaning RIGHT NOW could be your last chance to make money in stocks!

Click here to see his full prediction before this explosive profit window closes.

Regards,

Ryan McGrath

Co-Publisher, TrendLabs

3 Tech Stocks Down Over 60%—Which One Is Worth Buying?

Submitted by Leo Miller. Publication Date: 12/17/2025.

At a Glance

- Three tech stocks have dropped over 60% from their 52-week highs amid shifting investor sentiment.

- Each company faces unique headwinds—from valuation concerns to competitive threats and revenue cuts.

- One stock stands out as having the most compelling case for a long-term recovery.

Investors know that tech stocks can be both rewarding and punishing for portfolios. As technology evolves, the competitive landscape can shift quickly. Hype-driven rallies can produce sizable gains for a time, but they often end in harsh corrections.

Three notable tech stocks have fallen more than 60% from their 52-week highs—but which one has the strongest potential for a meaningful recovery?

IPO Mania Fades Quickly at FIG

Shadow Bank could siphon $6.6 Trillion in deposits (Ad)

Recent changes in U.S. digital currency policy could have far-reaching implications for how money moves through the financial system.

A new analysis explores how emerging stablecoin regulations may reshape banking, deposits, and retirement planning — and why some experts believe individuals should understand these shifts sooner rather than later. The report also outlines strategies investors are using to prepare for potential structural changes in the monetary landscape.

Figma (NYSE: FIG) got off to a spectacular start after going public in July. Shares closed at $122 on Aug. 1, up roughly 370% from their IPO price of $33. Since then, the stock has traded almost straight down. As of Dec. 15, shares were near $35, a 71% drop from their 52-week closing high. That decline reflects an initially elevated valuation more than any obvious weakness in the business.

Revenue grew a brisk 38% last quarter, and the company raised both sales and operating profit guidance for the full year. Figma added over 1,000 new paying customers, bringing paid client count to just above 12,900. The company is also investing heavily in artificial intelligence (AI), which has pressured its adjusted free cash flow margin—down from 31% a year ago to 18% last quarter. Even after the sell-off, Figma still trades at a very high forward price-to-earnings (P/E) ratio—north of 150x—leaving shares vulnerable to further pressure.

CoreWeave Drops More Than 60% Below Its High

A neo-cloud operator, CoreWeave (NASDAQ: CRWV) benefited from its close relationship with NVIDIA (NASDAQ: NVDA). NVIDIA's investment in CoreWeave and access to its advanced computing systems helped fuel investor confidence.

In mid-June, CoreWeave hit a 52-week closing high near $183. The stock, however, has fallen sharply since late October and closed near $72 on Dec. 15—down about 61% from that peak. The pullback reflects a broader retreat in speculative AI and cloud-related names, and CoreWeave's Nov. 10 earnings didn't help: the stock plunged 16% the next day after the firm cut its 2025 revenue guidance.

CoreWeave reports a massive backlog of roughly $55 billion—nearly 13 times its trailing-12-month revenue. At the same time, the company carries about $18 billion in debt and spent nearly $10 billion on capital expenditures over the past 12 months. With rising scrutiny on companies building AI infrastructure, CoreWeave could face more challenges before conditions improve. The company isn't expected to be profitable over the next 12 months, so it does not have a forward P/E ratio.

Amazon Worries Leave TTD Down Over 70%

Finally, The Trade Desk (NASDAQ: TTD) closed near $36 on Dec. 15, down about 73% from its 52-week high. The shares were heavily punished after the company's Q2 2025 earnings report, tumbling 39% on Aug. 8 despite beating sales estimates and missing adjusted EPS by only one cent.

Investors appear particularly sensitive to any slip-up amid fears of competition from Amazon.com (NASDAQ: AMZN). Amazon has been scaling its demand-side advertising platform and is increasingly seen as a threat to The Trade Desk's client base. The prospect of clients migrating to Amazon raises genuine concerns about the company's future growth trajectory.

Even so, current prices may overstate the risks. While growth has slowed, The Trade Desk's margins remain strong and its total addressable market continues to expand. The Trade Desk's forward P/E of around 18x is the lowest in its history and sits well below the 28x forward P/E of the S&P 500 tech sector.

TTD Comes Out on Top

Of the three, The Trade Desk looks best positioned for a meaningful rebound. Amazon's growing ad business is a legitimate headwind, but the magnitude of TTD's decline seems out of step with its fundamentals.

With resilient margins, a growing addressable market, and a forward P/E well below sector averages, The Trade Desk offers the clearest path to recovery—and potential outperformance if sentiment turns positive.

This message is a sponsored email sent on behalf of Trend Labs, a third-party advertiser of MarketBeat. Why was I sent this message?.

If you have questions about your newsletter, please contact MarketBeat's South Dakota based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

Copyright 2006-2025 MarketBeat Media, LLC.

345 N Reid Place #620, Sioux Falls, South Dakota 57103-7078. USA..