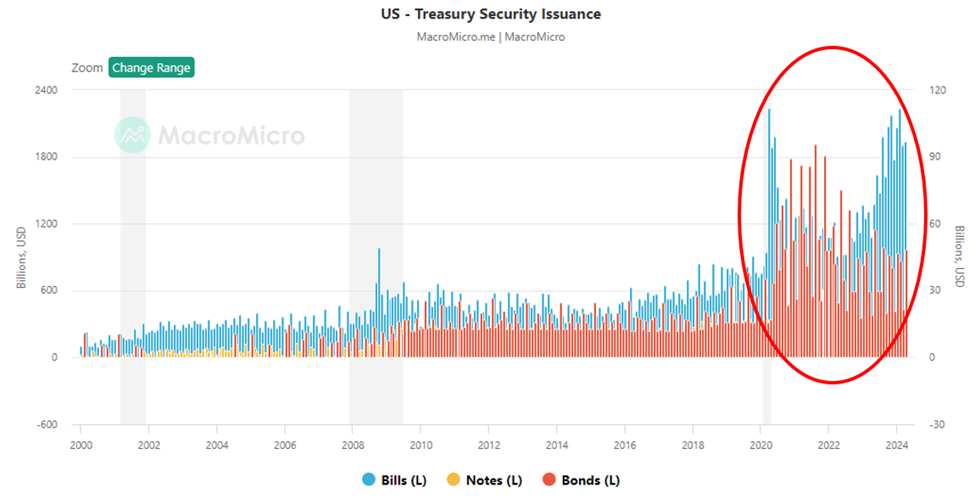

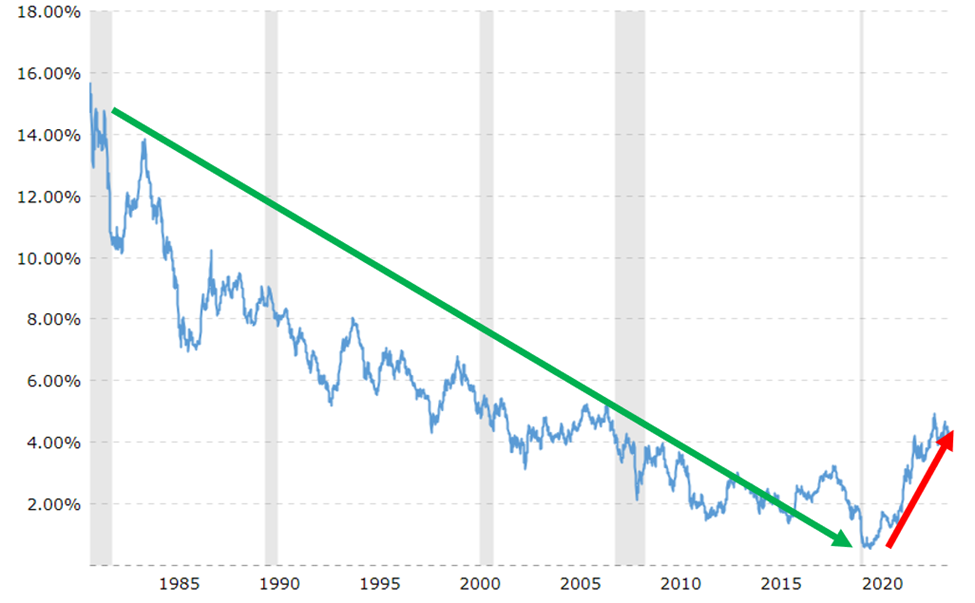

The 10-year Treasury yield briefly takes out 4.0% … who’s buying bitcoin and what it means … can we ignore the Sahm Rule this time around? It’s been a busy news week. Today, let’s look at three stories likely impacting your portfolio. Keep your eye on the 10-year Treasury yield On Monday, the most important number in investing – the 10-year Treasury yield – hit a multi-month low of about 3.67%. By yesterday, it had shot back up, briefly retaking 4.0% (as I write Friday morning, it's eased to 3.94%). What's behind the surge? Part of the answer comes from Wednesday and a little detail that most investors missed. It also helps explain Wednesday's painful reversal in the stock market that took the Nasdaq from "up 2%" to end the day "down 1%." Here's MarketWatch: An auction of 10-year Treasury notes was poorly received early Wednesday afternoon, contributing to a rise in yields and appearing to take the steam out of a rally by stocks. It turns out, the tail on the $42 billion auction of 10-year notes was 3 basis points. If you're less familiar with the term, a "tail" is the difference between the yield on the bond before the auction and the yield that buyers are willing to transact at during the auction. This was the bond market's way of saying, "Nope, if you want us to buy all these treasuries, you need to sweeten the deal." The pattern repeated on Thursday when the 30-year bond auction was met with below-average demand. In this case, the tail was 3.1 basis point. Analyst Jim Bianco points out that it was "the 7th worst long-bond monthly auction since Covid." From a short-term perspective, this is just noise, and unlikely to influence the Fed's interest rate policy Here's legendary investor Louis Navellier from yesterday's Flash Alert podcast in Growth Investor. The 10-year bond auction wasn't perfect. So, it shows that if yields get too low, no one wants to buy the bonds. But bond yields are still much lower than they were a few weeks ago, as are two-year notes. So, the Fed still is under pressure to cut [interest rates]. From a longer-term perspective, this is another piece of data pointing toward a "new normal" of higher bond yields. The lower yields in the 2010s were a huge contributor to that decade's epic bull run. As we've walked through here in the Digest, our government is broke, and needs more money to pay for all its promised obligations. Tax revenues alone are woefully insufficient. So, our government has been funding the shortfall through debt – its treasuries market. As you can see below, we've had an explosion of treasury issuance since 2020.  The problem is that when new treasury issuance floods the market, the oversupply results in lower prices that are needed to entice buyers (like what happened on Wednesday and Thursday). And since bond prices and yields are inversely correlated, this means bond yields rise. That's not good for stocks or for the federal government's debt service (and eventually, the value of your savings in dollars). Remember – in 2020, the cardinal direction of the 10-year Treasury note reversed for the first time in forty years…  Source: MacroTrends.net If this trajectory continues – as it has been doing over the last four years – it will be the single greatest influence on your portfolio this decade. | ADVERTISEMENT  Retirement is a long-term game, right?

But what if one path to amassing wealth over the long term... is short-term trading?

Specifically, pocketing fast profits in stocks experiencing upside breakouts?

Luke Lango has developed a system for identifying stocks that could shoot higher over the next few weeks.

With the help of a powerful tool, he calls “Prometheus,” he’s recommended breakout stocks that gained 22%-88%, sometimes in just a few weeks.

In a recent interview, he explained how he developed Prometheus, and how it could help almost anyone who’s concerned about their retirement.

Watch this video now. | Switching gears to the crypto market, there’s a “tale of two investors” playing out Crypto investors have had a painful summer. While hopes were high for a post-halving surge back in the spring, the opposite has played out. Due to a handful of factors that we've detailed in various Digests, the price of bitcoin and top-tier altcoins have collapsed. But there's an interesting story playing out beneath the surface… While small investors have been dumping their bitcoin holdings, large investors have been accumulating rapidly. From CoinDesk: Bitcoin (BTC) investors endured a (mostly down) rollercoaster of action as prices plummeted through the weekend to $49,000 by early Monday before modestly rebounding to around the $56,000 level in morning U.S. hours, triggering diverse reactions by holders. Bitcoin whales, or large asset holders, seized the opportunity of lower prices to purchase, while small investors sold as the panic ensued, data by blockchain analytics firm IntoTheBlock shows. Crypto wallets holding between 1,000 and 10,000 BTC, worth roughly $56 million and $560 million at current prices, "demonstrated confidence during the recent dip, consistently increasing their holdings as prices fell," IntoTheBlock analysts said. Meanwhile, wallets with less than 1 BTC "showed weak hands, with the most substantial decrease in holdings during yesterday's market downturn, they added. In yesterday's Digest, we looked at how small retail investors sold stocks during this week's volatility while institutional investors bought hand-over-fist. Clearly, the same dynamic is playing out in the crypto market. Be on guard against such fear-based kneejerk selling. Remember – crypto and volatility go together like peanut butter and jelly. So, if you're not prepared for some gut-wrenching drawdowns, stay away. But if you can handle the rollercoaster ride, history suggests the reward will be worth it, despite the bears proclaiming "bitcoin is dead" every time it crashes (before surging to a new high later). As to where bitcoin goes next, let's check in with our crypto expert Luke Lango. From his weekend update in Crypto Investor Network: On a short-term basis, BTC is forming a converging triangle pattern between its uptrend support line from late 2022 and its downtrend resistance line from March 2024. Those two lines will converge by September. Between now and then, we expect BTC to either stage a downside breakdown of the uptrend support line from late 2022, or an upside breakout of the downtrend resistance line from March 2024. We favor the odds of the latter.  Overall, then, we're feeling bullish. We understand the price-action has been frustrating. But we believe patience will be rewarded here. The fundamentals support higher prices. We just have to play the waiting game for now.

| ADVERTISEMENT  There’s a unique situation in the stock market, right now, that gives you the opportunity to take advantage of AI in a way that many folks overlook entirely.

Here’s how one small change to your portfolio could grow your wealth faster than ever before.

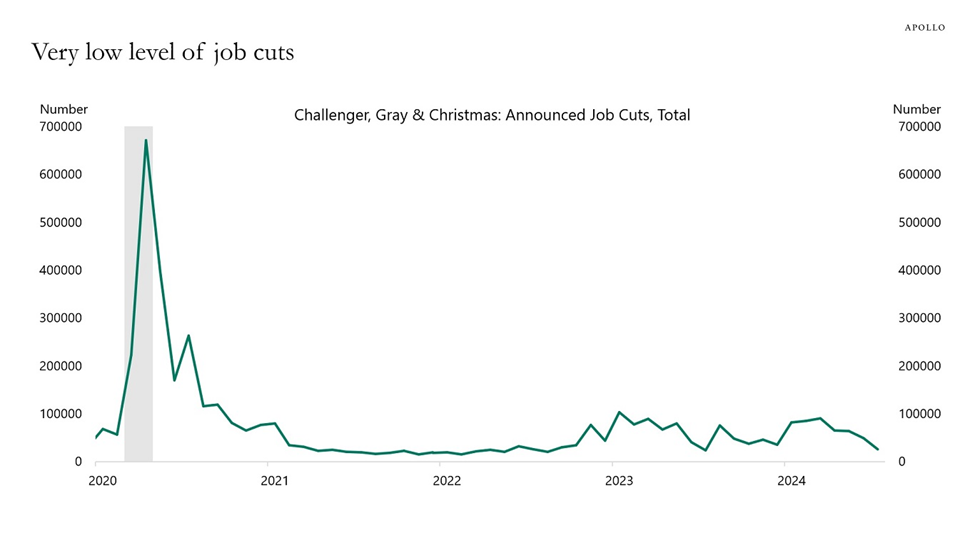

Click here to learn more. | Finally, can we ignore this major recession indicator? In recent months, we've highlighted the "Sahm Rule." Named after Claudia Sahm, former Federal Reserve economist and the originator of the indicator, the "Sahm Rule" compares the latest three-month average of the unemployment rate with the lowest three-month average over the past year. When the latest three-month average is 0.5 percentage points higher than the lowest three-month average, the Sahm Rule triggers, suggesting the beginning of a new recession. Since 1950, there has only one false positive (in 1959). But even in that case, the U.S. entered a recession six months later. The indicator correctly flagged the other 11 recessions. One week ago today, the Sahm Rule triggered as the value hit 0.53. But is this a case of "this time is different"? According to Torsten Slok at Apollo, yes: The uptrend in immigration continues with a near record-high level of immigrant visas issued every month… Maybe the reason why the unemployment rate is rising is because the government is gradually working through a Covid-related backlog of visa applications, which increases the labor supply. The source of the rise in the unemployment rate is not job cuts but a rise in labor supply because of rising immigration. That is the reason why the Sahm rule doesn't work. The Sahm rule was designed for a decline in labor demand, not a rise in immigration. If Slok is correct, we can corroborate that by looking at job cuts. However, when we do, we get a mixed result. In favor of Slok's point is the chart below from executive outplacement firm Challenger, Gray & Christmas that shows a low level of announced job cuts. We're looking at a four-year period dating to 2020.  But working against Slok's point is how the chart is skewed by the pandemic spike. If that were excluded, it would be easier to see that today's value is 9% higher than where we were one year ago at this time. It's also the highest total for the month since 2020. Plus, if we change our focus from "announced job cuts" to "hiring plans," we find weakness. From Challenger, Gray & Christmas: U.S. employers announced plans to hire 3,676 workers in July… It is the lowest total for July since Challenger began keeping detailed hiring announcements in 2009. For the year, employers have announced plans to hire 73,596 workers, the lowest year-to-date total since 2012, when 72,858 hiring plans were recorded. Given this, while we hope Slok's takeaway is correct, we continue to view the Sahm Rule's recent triggering with great respect and caution. To be clear, this doesn't mean get out of the market. But, tying back to yesterday's Digest, it does mean you should refamiliarize yourself with why you'll ignore volatility in your long-term "hold forever" stocks…and why it's critical to have, and follow, stop-losses for the positions you don't hold with ironclad conviction. That way, if the rally we're enjoying today runs out of steam, you're covered either way. We'll keep you updated on all these stories here in the Digest. Have a good evening, Jeff Remsburg

|