| The World's First "$20 Trillion Drug"? (ad) |

The World's First "$20 Trillion Drug?" One small biotech holds the key to a revolution in treating Alzheimer's disease. Jeff Bezos, Goldman Sachs & Big Pharma giants have invested billions into this unknown biotech. Our research proves that anyone who gets in today could see 113,000% gains!

Get the name of the stock here |

|

| 2023's Best Stock: Buy Before the Market Knows (ad) |

There is a recession-proof company that is poised to grow in the coming years. Our research team has given them our highest score as a solid addition to any portfolio.

By clicking link you are subscribing to The Darwin Investor Network and may receive up to 2 additional free bonus subscriptions. Unsubscribing is easy. Full disclosures found here.

Download The Full Report Here for Free |

|

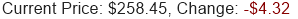

Apple Inc. (AAPL) Apple Inc. (AAPL)    Amazon.com, Inc. (AMZN) Amazon.com, Inc. (AMZN)    Alphabet Inc. (GOOGL) Alphabet Inc. (GOOGL)    Meta Platforms, Inc. (META) Meta Platforms, Inc. (META)   - insider Jennifer Newstead sold 585 shares of the firm's stock in a transaction dated Tuesday, March 12th. The stock was sold at an average price of $493.75, for a total transaction of $288,843.75. Following the sale, the insider now owns 40,738 shares of the company's stock, valued at approximately $20,114,387.50. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink.

- (3/15) Capital Investment Advisors LLC Acquires 3,742 Shares of Meta Platforms, Inc. (NASDAQ:META) (marketbeat.com)

- (3/15) Meta Platforms, Inc. (NASDAQ:META) Insider Sells $288,843.75 in Stock (insidertrades.com)

- (3/15) Wall Street Analysts See Meta Platforms (META) as a Buy: Should You Invest? (zacks.com)

- (3/15) Watch for Tech Giants to Boost Share Buybacks in 2024 (marketbeat.com)

- (3/15) Meta Platforms, Inc. (META) is Attracting Investor Attention: Here is What You Should Know (zacks.com)

- (3/15) Watch for Tech Giants to Boost Share Buybacks in 2024 (META) (marketbeat.com)

- (3/15) Scrap coercive 'privacy fee', MEPs urge Meta's Nick Clegg in open letter (techcrunch.com)

- (3/15) Experts rubbish online claim that Meta platforms outage was 'effect of solar flares' (msn.com)

- (3/15) TikTok Ban a Big Boost for Meta (msn.com)

- (3/15) Insiders sell almost $2 billion worth of Meta stock (finbold.com)

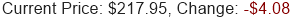

Microsoft Co. (MSFT) Microsoft Co. (MSFT)   - Cardlytics (NASDAQ:CDLX) was upgraded by analysts at Craig Hallum from a "hold" rating to a "buy" rating. They now have a $18.00 price target on the stock, up previously from $10.00. This represents a 46.0% upside from the current price of $12.33.

- Cummins (NYSE:CMI) was upgraded by analysts at UBS Group AG from a "neutral" rating to a "buy" rating.The current price is $271.85.

- DoorDash (NASDAQ:DASH) was upgraded by analysts at Piper Sandler from an "underweight" rating to a "neutral" rating. They now have a $127.00 price target on the stock, up previously from $53.00. This represents a 3.8% downside from the current price of $132.06.

- Dollar General (NYSE:DG) was upgraded by analysts at Telsey Advisory Group from a "market perform" rating to an "outperform" rating. They now have a $170.00 price target on the stock. This represents a 11.8% upside from the current price of $152.11.

- HF Sinclair (NYSE:DINO) was upgraded by analysts at Bank of America Co. from a "neutral" rating to a "buy" rating. They now have a $78.00 price target on the stock, up previously from $62.00. This represents a 30.8% upside from the current price of $59.64.

- Madrigal Pharmaceuticals (NASDAQ:MDGL) was upgraded by analysts at B. Riley from a "sell" rating to a "neutral" rating. They now have a $270.00 price target on the stock, up previously from $155.00. This represents a 2.3% upside from the current price of $263.95.

- nCino (NASDAQ:NCNO) was upgraded by analysts at Morgan Stanley from an "underweight" rating to an "equal weight" rating. They now have a $27.00 price target on the stock, up previously from $24.00. This represents a 8.6% downside from the current price of $29.55.

- PBF Energy (NYSE:PBF) was upgraded by analysts at Bank of America Co. from a "neutral" rating to a "buy" rating. They now have a $74.00 price target on the stock, up previously from $52.00. This represents a 29.5% upside from the current price of $57.14.

- PACCAR (NASDAQ:PCAR) was upgraded by analysts at UBS Group AG from a "neutral" rating to a "buy" rating.The current price is $117.53.

- Rivian Automotive (NASDAQ:RIVN) was upgraded by analysts at Piper Sandler from a "neutral" rating to an "overweight" rating. They now have a $21.00 price target on the stock, up previously from $15.00. This represents a 90.0% upside from the current price of $11.05.

- Snowflake (NYSE:SNOW) was upgraded by analysts at Guggenheim from a "sell" rating to a "neutral" rating.The current price is $157.86.

- Southern States Bancshares (NASDAQ:SSBK) was upgraded by analysts at Keefe, Bruyette & Woods from a "market perform" rating to an "outperform" rating. They now have a $35.00 price target on the stock, up previously from $32.00. This represents a 39.8% upside from the current price of $25.03.

- THOR Industries (NYSE:THO) was upgraded by analysts at Citigroup Inc. from a "neutral" rating to a "buy" rating. They now have a $122.00 price target on the stock, up previously from $111.00. This represents a 18.9% upside from the current price of $102.63.

- Valero Energy (NYSE:VLO) was upgraded by analysts at Bank of America Co. from a "neutral" rating to a "buy" rating. They now have a $210.00 price target on the stock, up previously from $156.00. This represents a 28.2% upside from the current price of $163.84.

- View today's most recent analysts' upgrades at MarketBeat.com

| Unlock March's Top 5 Stocks Poised for Exceptional Gains! (ad) |

As March unfolds, the investment horizon brims with opportunity. Don't miss out on the chance to elevate your portfolio with our expertly curated list of 5 stocks. These picks are not just promising; they're positioned to potentially deliver substantial returns in the dynamic market landscape of 2024. With a keen eye on innovation and growth potential, our selection is designed to secure your spot at the forefront of this month's investment wave. Act now to gain exclusive access to these high-potential stocks and watch your investments thrive. Time is of the essence - secure your financial future today!

Click here to unveil the stocks that are set to soar. |

|

- Futu (NASDAQ:FUTU) was downgraded by analysts at JPMorgan Chase & Co. from an "overweight" rating to a "neutral" rating. They now have a $62.00 price target on the stock, down previously from $64.00. This represents a 10.9% upside from the current price of $55.92.

- Republic Services (NYSE:RSG) was downgraded by analysts at Morgan Stanley from an "overweight" rating to an "equal weight" rating. They now have a $199.00 price target on the stock. This represents a 7.0% upside from the current price of $186.03.

- View today's most recent analysts' downgrades at MarketBeat.com

| Weekly Earnings are possible with this Secret Investment Strategy! (ad) |

Discover a reliable income stream that's flying under the radar! Our Ebook unveils a low-risk investment tactic ideal for small investors. Learn to secure your weekly "paycheck" and gain FREE access to Chuck's Trade of the Day eLetter. Don't miss out on this hidden gem…

Start transforming your financial future today! |

|

- ANI Pharmaceuticals (NASDAQ:ANIP) is now covered by analysts at Capital One Financial Co.. They set an "overweight" rating and a $80.00 price target on the stock. This represents a 21.4% upside from the current price of $65.91.

- APi Group (NYSE:APG) is now covered by analysts at Jefferies Financial Group Inc.. They set a "buy" rating and a $48.00 price target on the stock. This represents a 25.5% upside from the current price of $38.26.

- BorgWarner (NYSE:BWA) is now covered by analysts at Piper Sandler. They set an "overweight" rating and a $43.00 price target on the stock. This represents a 34.1% upside from the current price of $32.06.

- Famous Dave's of America (NASDAQ:DAVE) is now covered by analysts at Barrington Research. They set a "market perform" rating on the stock.The current price is $35.22.

- Expeditors International of Washington (NASDAQ:EXPD) is now covered by analysts at Bank of America Co.. They set a "neutral" rating and a $126.00 price target on the stock. This represents a 5.7% upside from the current price of $119.16.

- Ford Motor (NYSE:F) is now covered by analysts at Piper Sandler. They set a "neutral" rating and a $13.00 price target on the stock. This represents a 7.0% upside from the current price of $12.15.

- Fortress Biotech (NASDAQ:FBIO) is now covered by analysts at Roth Mkm. They set a "buy" rating and a $10.00 price target on the stock. This represents a 440.5% upside from the current price of $1.85.

- Five9 (NASDAQ:FIVN) is now covered by analysts at Royal Bank of Canada. They set an "outperform" rating and a $80.00 price target on the stock. This represents a 34.9% upside from the current price of $59.29.

- Golden Entertainment (NASDAQ:GDEN) is now covered by analysts at Truist Financial Co.. They set a "buy" rating and a $45.00 price target on the stock. This represents a 32.4% upside from the current price of $33.99.

- General Motors (NYSE:GM) (TSE:GMM.U) is now covered by analysts at Piper Sandler. They set a "neutral" rating and a $44.00 price target on the stock. This represents a 9.6% upside from the current price of $40.15.

- Mobileye Global (NASDAQ:MBLY) is now covered by analysts at Piper Sandler. They set a "neutral" rating and a $31.00 price target on the stock. This represents a 11.0% upside from the current price of $27.94.

- Pure Storage (NYSE:PSTG) is now covered by analysts at Citigroup Inc.. They set a "buy" rating and a $65.00 price target on the stock. This represents a 28.8% upside from the current price of $50.46.

- PowerFleet (NASDAQ:PWFL) is now covered by analysts at Craig Hallum. They set a "buy" rating and a $9.00 price target on the stock. This represents a 138.7% upside from the current price of $3.77.

- Solid Biosciences (NASDAQ:SLDB) is now covered by analysts at Citigroup Inc.. They set a "buy" rating and a $16.00 price target on the stock. This represents a 19.9% upside from the current price of $13.34.

- Stellantis (NYSE:STLA) is now covered by analysts at Piper Sandler. They set an "overweight" rating and a $39.00 price target on the stock. This represents a 37.3% upside from the current price of $28.40.

- TKO Group (NYSE:TKO) is now covered by analysts at Bank of America Co.. They set a "buy" rating and a $100.00 price target on the stock. This represents a 25.0% upside from the current price of $80.02.

- View today's most recent analysts' new coverage at MarketBeat.com

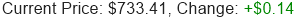

| Get 30 Days of MarketBeat All Access Free | | Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools: |

| - Best-in-Class Portfolio Monitoring

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. - Stock Ideas and Recommendations

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat's trending stocks report. - Advanced Stock Screeners and Research Tools

Identify stocks that meet your criteria using seven unique stock screeners. See what's happening in the market right now with MarketBeat's real-time news feed. Export data to Excel for your own analysis.

| START YOUR 30-DAY FREE TRIAL  |

|

| Upgrade Your Subscription |

Upgrade to MarketBeat All Access and receive your premium edition of MarketBeat Daily at 9:00 AM ET. UPGRADE NOW  |

|

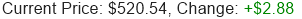

View and add up to five holdings to your watchlist.

VIEW MY PORTFOLIO  |

|

Join MarketBeat's free stock discussion and trading idea group on Facebook.

JOIN NOW  |

|

Thank you for subscribing to MarketBeat! We empower individual investors to make better trading decisions by providing real-time financial information and objective market research. MarketBeat is a small business and email is a crucial tool for us to share information, news, trading ideas and financial products and services with our subscribers (that's you!). If you have questions about your subscription, feel free to contact our U.S. based support team via email at contact@marketbeat.com. If you would like to unsubscribe or change which emails you receive, you can manage your mailing preferences or unsubscribe from these emails. © 2006-2024 MarketBeat Media, LLC. 345 N Reid Place, Suite 620, Sioux Falls, SD 57103 . United States. Today's Bonus Content: Top Analyst Exposes Imminent Crisis Hurtling Towards America |

|