| Americans Now Favor Gold Over Stocks as an Investment Vehicle (ad) |

|

| Wall Street wants you to think that making money has to be complicated… but it isn't (ad) |

Wall Street wants you to think that making money has to be complicated and time-consuming…

But as a former hedge fund manager and 35-year trading vet…

I can tell you that targeting extra cash each week is actually way easier than you might think.

As a matter of fact, you can get started with only a few minutes and a couple clicks of the mouse…

And it all starts with placing what I call the "2-Step Trade"…

Because after just two steps, you can set yourself up to target $500 in extra income by the end of the week.

Click here now and I'll place one of these "2-Step Trades" live - before your very own eyes |

|

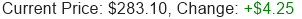

Apple Inc. (AAPL) Apple Inc. (AAPL)    Amazon.com, Inc. (AMZN) Amazon.com, Inc. (AMZN)   - CEO Adam Selipsky sold 500 shares of the business's stock in a transaction dated Thursday, February 1st. The stock was sold at an average price of $155.72, for a total transaction of $77,860.00. Following the completion of the transaction, the chief executive officer now directly owns 116,560 shares in the company, valued at $18,150,723.20. The transaction was disclosed in a document filed with the SEC, which is available through this link.

- (2/6) Peloton stock backpedals to a new low as shorts win (AMZN) (marketbeat.com)

- (2/6) Truist Financial Reaffirms Their Buy Rating on Amazon (AMZN) (markets.businessinsider.com)

- (2/6) Amazon.com, Inc. Just Recorded A 7.9% EPS Beat: Here's What Analysts Are Forecasting Next (uk.finance.yahoo.com)

- (2/6) Buy Rating for Amazon: Strong Market Position and Growth Potential Across Segments (markets.businessinsider.com)

- (2/6) Amazon's New Deal Aims to Keep Ads Relevant Without Invading Your Privacy (msn.com)

- (2/6) 2 Top Growth Stocks to Buy If You Have $1,000 to Invest Today (fool.com)

- (2/6) Will Retail Or Cloud Lift Amazon Stock Higher After An 81% Gain? (finance.yahoo.com)

- (2/6) Alphabet triggers a sell-the-news reaction: Time to buy the dip? (AMZN) (marketbeat.com)

- (2/6) Amazon.com Q4 Earnings Transcript (marketbeat.com)

- (2/6) Amazon.com, Inc. (NASDAQ:AMZN) Stock Holdings Boosted by ESG Planning (marketbeat.com)

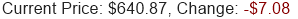

Alphabet Inc. (GOOGL) Alphabet Inc. (GOOGL)    Meta Platforms, Inc. (META) Meta Platforms, Inc. (META)    Microsoft Co. (MSFT) Microsoft Co. (MSFT)   - Everbridge (NASDAQ:EVBG) was upgraded by analysts at Wells Fargo & Company from an "underweight" rating to an "equal weight" rating.The current price is $28.17.

- Li Auto (NASDAQ:LI) was upgraded by analysts at Deutsche Bank Aktiengesellschaft from a "hold" rating to a "buy" rating. They now have a $41.00 price target on the stock, down previously from $45.00. This represents a 34.9% upside from the current price of $30.39.

- Open Lending (NASDAQ:LPRO) was upgraded by analysts at Morgan Stanley from an "underweight" rating to an "equal weight" rating. They now have a $7.00 price target on the stock, up previously from $4.00. This represents a 5.0% downside from the current price of $7.37.

- Palantir Technologies (NYSE:PLTR) was upgraded by analysts at Citigroup Inc. from a "sell" rating to a "neutral" rating. They now have a $20.00 price target on the stock, up previously from $10.00. This represents a 5.4% downside from the current price of $21.15.

- Palantir Technologies (NYSE:PLTR) was upgraded by analysts at Jefferies Financial Group Inc. from an "underperform" rating to a "hold" rating. They now have a $22.00 price target on the stock, up previously from $13.00. This represents a 4.0% upside from the current price of $21.15.

- Tyson Foods (NYSE:TSN) was upgraded by analysts at Bank of America Co. from an "underperform" rating to a "neutral" rating. They now have a $62.00 price target on the stock, up previously from $47.00. This represents a 11.4% upside from the current price of $55.65.

- United Parcel Service (NYSE:UPS) was upgraded by analysts at UBS Group AG from a "neutral" rating to a "buy" rating. They now have a $175.00 price target on the stock, up previously from $160.00. This represents a 20.3% upside from the current price of $145.43.

- Varonis Systems (NASDAQ:VRNS) was upgraded by analysts at Wedbush from a "neutral" rating to an "outperform" rating. They now have a $65.00 price target on the stock, up previously from $35.00. This represents a 36.0% upside from the current price of $47.79.

- View today's most recent analysts' upgrades at MarketBeat.com

| Market Wizard who made $95 million for his clients in 2008 – and predicted the 2022 collapse (ad) |

|

- Koninklijke Ahold Delhaize (OTCMKTS:ADRNY) was downgraded by analysts at HSBC Holdings plc from a "hold" rating to a "reduce" rating.

- Bristol-Myers Squibb (NYSE:BMY) was downgraded by analysts at Redburn Atlantic from a "buy" rating to a "neutral" rating. They now have a $54.00 price target on the stock, down previously from $77.00. This represents a 8.2% upside from the current price of $49.89.

- Chegg (NYSE:CHGG) was downgraded by analysts at Piper Sandler from a "neutral" rating to an "underweight" rating. They now have a $8.50 price target on the stock, down previously from $9.00. This represents a 5.7% downside from the current price of $9.01.

- Chegg (NYSE:CHGG) was downgraded by analysts at Piper Sandler Companies to an "underweight" rating. They now have a $8.50 price target on the stock, down previously from $9.00. This represents a 5.7% downside from the current price of $9.01.

- CNA Financial (NYSE:CNA) was downgraded by analysts at Bank of America Co. from a "neutral" rating to an "underperform" rating. They now have a $43.00 price target on the stock, up previously from $39.00. This represents a 5.6% downside from the current price of $45.55.

- Chevron (NYSE:CVX) was downgraded by analysts at DZ Bank AG from a "buy" rating to a "hold" rating. They now have a $160.00 price target on the stock. This represents a 4.3% upside from the current price of $153.40.

- Embraer (NYSE:ERJ) was downgraded by analysts at HSBC Holdings plc from a "buy" rating to a "hold" rating. They now have a $19.00 price target on the stock, up previously from $18.00. This represents a 8.2% upside from the current price of $17.56.

- Euronav (NYSE:EURN) was downgraded by analysts at Deutsche Bank Aktiengesellschaft from a "buy" rating to a "hold" rating. They now have a $17.86 price target on the stock. This represents a 0.7% upside from the current price of $17.74.

- Fabrinet (NYSE:FN) was downgraded by analysts at Northland Securities from an "outperform" rating to a "market perform" rating. They now have a $200.00 price target on the stock. This represents a 18.6% upside from the current price of $168.70.

- Entain (OTCMKTS:GMVHY) was downgraded by analysts at Barclays PLC from an "overweight" rating to an "equal weight" rating.The current price is $12.44.

- Haynes International (NASDAQ:HAYN) was downgraded by analysts at Noble Financial from an "outperform" rating to a "market perform" rating.The current price is $59.80.

- Hut 8 (NASDAQ:HUT) was downgraded by analysts at HC Wainwright from a "neutral" rating to a "sell" rating. They now have a $5.50 price target on the stock. This represents a 20.6% downside from the current price of $6.93.

- Infosys (NYSE:INFY) was downgraded by analysts at HSBC Holdings plc from a "buy" rating to a "hold" rating.The current price is $20.53.

- Illinois Tool Works (NYSE:ITW) was downgraded by analysts at Wells Fargo & Company from an "equal weight" rating to an "underweight" rating. They now have a $240.00 price target on the stock, down previously from $277.00. This represents a 5.8% downside from the current price of $254.71.

- LVMH Moët Hennessy - Louis Vuitton, Société Européenne (OTCMKTS:LVMUY) was downgraded by analysts at HSBC Holdings plc from a "buy" rating to a "hold" rating.The current price is $168.15.

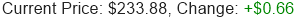

- McDonald's (NYSE:MCD) was downgraded by analysts at BTIG Research from a "buy" rating to a "neutral" rating.The current price is $283.26.

- Napco Security Technologies (NASDAQ:NSSC) was downgraded by analysts at Imperial Capital from an "outperform" rating to an "inline" rating. They now have a $45.00 price target on the stock. This represents a 4.6% upside from the current price of $43.01.

- Plug Power (NASDAQ:PLUG) was downgraded by analysts at UBS Group AG from a "buy" rating to a "neutral" rating. They now have a $4.75 price target on the stock. This represents a 7.2% upside from the current price of $4.43.

- RWE Aktiengesellschaft (OTCMKTS:RWEOY) was downgraded by analysts at Stifel Nicolaus from a "buy" rating to a "hold" rating.The current price is $36.31.

- Saia (NASDAQ:SAIA) was downgraded by analysts at Stifel Nicolaus from a "buy" rating to a "hold" rating. They now have a $526.00 price target on the stock, up previously from $484.00. This represents a 2.3% downside from the current price of $538.53.

- Tesla (NASDAQ:TSLA) was downgraded by analysts at Daiwa Capital Markets from an "outperform" rating to a "neutral" rating. They now have a $195.00 price target on the stock, down previously from $245.00. This represents a 6.7% upside from the current price of $182.77.

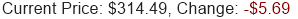

- Vertex Pharmaceuticals (NASDAQ:VRTX) was downgraded by analysts at Evercore ISI from an "outperform" rating to an "inline" rating. They now have a $438.00 price target on the stock, up previously from $436.00. This represents a 5.3% upside from the current price of $415.90.

- View today's most recent analysts' downgrades at MarketBeat.com

| We Could Be Less Than 3 Months Out from an AI Superevent (ad) |

According to one of the world’s top AI scientists, there’s a major event coming as soon as three months from today that could cause expensive tech stocks like Microsoft, Google, and NVIDIA to double or triple in price in the months ahead… but whatever you do, don’t go all in on big tech before you have all the details.

Click Here to Find Out More |

|

- Agiliti (NYSE:AGTI) is now covered by analysts at KeyCorp. They set a "sector weight" rating on the stock.The current price is $6.96.

- Alcon (NYSE:ALC) is now covered by analysts at KeyCorp. They set an "overweight" rating and a $87.00 price target on the stock. This represents a 13.0% upside from the current price of $76.98.

- Avadel Pharmaceuticals (NASDAQ:AVDL) is now covered by analysts at UBS Group AG. They set a "buy" rating and a $21.00 price target on the stock. This represents a 39.2% upside from the current price of $15.09.

- Axsome Therapeutics (NASDAQ:AXSM) is now covered by analysts at UBS Group AG. They set a "buy" rating and a $111.00 price target on the stock. This represents a 18.7% upside from the current price of $93.50.

- Bloom Energy (NYSE:BE) is now covered by analysts at Redburn Atlantic. They set a "neutral" rating and a $12.50 price target on the stock. This represents a 10.3% upside from the current price of $11.33.

- Biohaven (NYSE:BHVN) is now covered by analysts at UBS Group AG. They set a "buy" rating and a $59.00 price target on the stock. This represents a 25.6% upside from the current price of $46.96.

- Biomea Fusion (NASDAQ:BMEA) is now covered by analysts at Truist Financial Co.. They set a "buy" rating and a $55.00 price target on the stock. This represents a 195.4% upside from the current price of $18.62.

- Cooper Companies (NYSE:COO) is now covered by analysts at KeyCorp. They set a "sector weight" rating on the stock.The current price is $374.34.

- Sprinklr (NYSE:CXM) is now covered by analysts at Rosenblatt Securities. They set a "buy" rating and a $16.00 price target on the stock. This represents a 28.8% upside from the current price of $12.42.

- Flywire (NASDAQ:FLYW) is now covered by analysts at Deutsche Bank Aktiengesellschaft. They set a "buy" rating and a $27.00 price target on the stock. This represents a 23.9% upside from the current price of $21.80.

- Honest (NASDAQ:HNST) is now covered by analysts at Alliance Global Partners. They set a "buy" rating and a $5.75 price target on the stock. This represents a 80.8% upside from the current price of $3.18.

- ICU Medical (NASDAQ:ICUI) is now covered by analysts at KeyCorp. They set an "overweight" rating and a $134.00 price target on the stock. This represents a 40.1% upside from the current price of $95.63.

- Inspire Medical Systems (NYSE:INSP) is now covered by analysts at KeyCorp. They set an "overweight" rating and a $278.00 price target on the stock. This represents a 25.8% upside from the current price of $220.97.

- Integer (NYSE:ITGR) is now covered by analysts at KeyCorp. They set an "overweight" rating and a $125.00 price target on the stock. This represents a 18.5% upside from the current price of $105.52.

- LeddarTech (NASDAQ:LDTC) is now covered by analysts at Roth Mkm. They set a "buy" rating and a $7.00 price target on the stock. This represents a 80.4% upside from the current price of $3.88.

- LeMaitre Vascular (NASDAQ:LMAT) is now covered by analysts at KeyCorp. They set a "sector weight" rating on the stock.The current price is $59.34.

- Paycom Software (NYSE:PAYC) is now covered by analysts at BTIG Research. They set a "neutral" rating on the stock.The current price is $195.87.

- Paylocity (NASDAQ:PCTY) is now covered by analysts at BTIG Research. They set a "buy" rating and a $200.00 price target on the stock. This represents a 21.7% upside from the current price of $164.32.

- Plug Power (NASDAQ:PLUG) is now covered by analysts at Redburn Atlantic. They set a "neutral" rating and a $4.50 price target on the stock. This represents a 1.6% upside from the current price of $4.43.

- Paycor HCM (NASDAQ:PYCR) is now covered by analysts at BTIG Research. They set a "buy" rating and a $26.00 price target on the stock. This represents a 31.3% upside from the current price of $19.80.

- ResMed (NYSE:RMD) is now covered by analysts at KeyCorp. They set an "overweight" rating and a $227.00 price target on the stock. This represents a 18.2% upside from the current price of $192.08.

- Sotera Health (NASDAQ:SHC) is now covered by analysts at KeyCorp. They set a "sector weight" rating on the stock.The current price is $15.37.

- STERIS (NYSE:STE) is now covered by analysts at KeyCorp. They set an "overweight" rating and a $253.00 price target on the stock. This represents a 12.2% upside from the current price of $225.54.

- TKO Group (NYSE:TKO) is now covered by analysts at Northcoast Research. They set a "buy" rating and a $105.00 price target on the stock. This represents a 21.4% upside from the current price of $86.46.

- UFP Technologies (NASDAQ:UFPT) is now covered by analysts at KeyCorp. They set a "sector weight" rating on the stock.The current price is $172.55.

- View today's most recent analysts' new coverage at MarketBeat.com

| Get 30 Days of MarketBeat All Access Free | | Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools: |

| - Best-in-Class Portfolio Monitoring

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio. - Stock Ideas and Recommendations

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat's trending stocks report. - Advanced Stock Screeners and Research Tools

Identify stocks that meet your criteria using seven unique stock screeners. See what's happening in the market right now with MarketBeat's real-time news feed. Export data to Excel for your own analysis.

| START YOUR 30-DAY FREE TRIAL  |

|

| Upgrade Your Subscription |

Upgrade to MarketBeat All Access and receive your premium edition of MarketBeat Daily at 9:00 AM ET. UPGRADE NOW  |

|

View and add up to five holdings to your watchlist.

VIEW MY PORTFOLIO  |

|

Join MarketBeat's free stock discussion and trading idea group on Facebook.

JOIN NOW  |

|

Thank you for subscribing to MarketBeat! We empower individual investors to make better trading decisions by providing real-time financial information and objective market research. MarketBeat is a small business and email is a crucial tool for us to share information, news, trading ideas and financial products and services with our subscribers (that's you!). If you have questions about your subscription, feel free to contact our U.S. based support team via email at contact@marketbeat.com. If you would like to unsubscribe or change which emails you receive, you can manage your mailing preferences or unsubscribe from these emails. © 2006-2024 American Consumer News, LLC dba MarketBeat. 345 N Reid Place, Suite 620, Sioux Falls, SD 57103 . United States. Today's Bonus Content: 9X better than the S&P 500 |

|