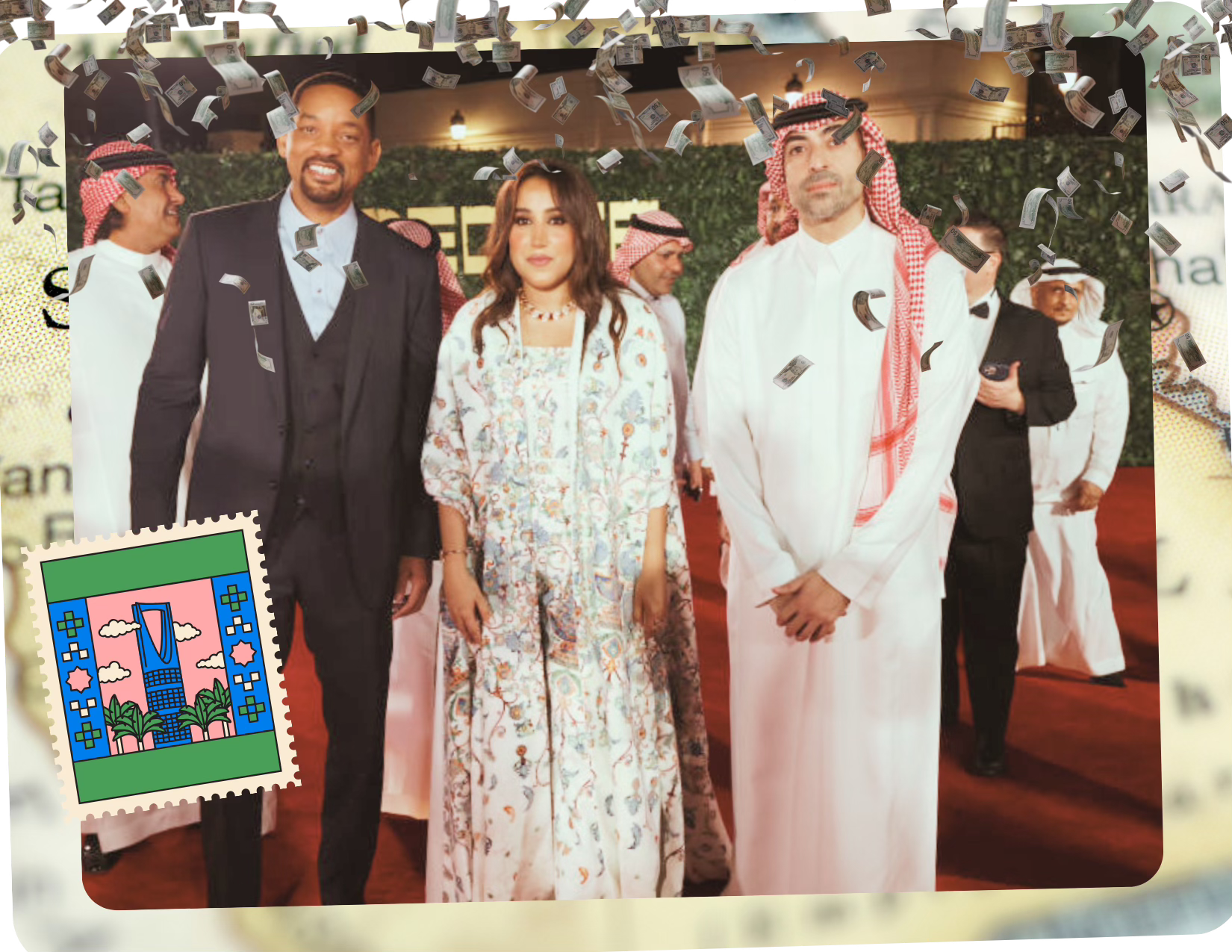

H'wood Saudi Pivot: the Players and PlaybookA look at the souk as big money proves irresistible post-KhashoggiAs U.S. media companies pull back spending on their overseas expansion efforts, cash-rich public and private entities in Saudi Arabia are stepping in at a rapid clip. Some indication of the volume of new business being conducted in the region? The number of U.S. law firms opening offices in the capital Riyadh. In November, Gibson Dunn launched a new office, raiding rival White and Case for seven lawyers, and has added 14 new partners in the Gulf region in the past year. Kirkland and Ellis also set up shop there in the past few months after Saudi Arabia passed a new law encouraging dealmakers to conduct their work inside the Kingdom. Greenberg Traurig and London-based Mischcon de Reya are among other firms opening. As my colleague Sean McNulty says, first come the lawyers, then come the deals. And they are coming. For a domestic entertainment industry desperate for money in high interest times, coupled with the industry's track record on saying yes to money no matter where it comes from, one can’t be too surprised if 2018 seems like ancient times. To refresh: That was the year Washington Post journalist Jamal Khashoggi was murdered at the Saudi consulate in Istanbul. The CIA concluded that the act was state sponsored. In the wake of that act, major U.S. corporations shunned the country’s investments, with Endeavor’s Ari Emanuel returning $400 million from the Public Investment Fund (the PIF), directed by Crown Prince Mohammed bin Salman (a.k.a. MBS.) Fast forward to today:

But the money doesn’t stop there. The Saudi government’s Vision 2030 initiative is aimed at diversifying the country’s economy away from its traditional reliance on oil supply, with the entertainment industry part of those efforts. And unlike Western countries, the Saudi royal family, in particular MBS, is firmly in charge of expansion plans through its $700 billion Public Investment Fund, one of the world’s largest sovereign wealth funds. It holds investments in Blackstone (the backer of Candle Media, holder of Hello Sunshine), Uber and a 10 percent stake in Telefonica, to name a few. And if sports was part one, part two of the Saudi soft-power charm offensive appears to be traditional filmed entertainment, where the opportunities and power players are presently being reshaped. Tarak Ben Ammar, the noted Tunisian film producer and distributor, told U.K. film news site Screen Daily that the Saudi film industry is like “California in the 1920s when cinema really blew up.” Today I’ll tell you:

Subscribe to The Ankler. to read the rest.Become a paying subscriber of The Ankler. to get access to this post and other subscriber-only content. A subscription gets you:

|